Kita Budget

Login/Sign Up

Spend Duit Wisely, Save Effortlessly

Turn your financial goals into reality with an easy-to-use budgeting tool designed for Malaysians.

Eat Outside

Budgets RM 1,000.00

Spent RM 256.20

Spendable

RM 743.80

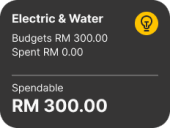

Electricity + Water Utility Bills

Budgets RM 300.00

Spent RM 280.00

Spendable

RM 20.00

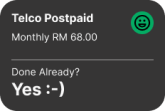

Car Instalment

Monthly RM 1,450.00

Done Already?

Yes :-)

Salary -> Budgets Calculator

Commitment Loads

Manage Breakdowns

My monthly nett salary*

*Nett salary is your salary after EPF, SOCSO and Tax deduction.

Select your commitments load and preferred saving percentage.

50% Commitment

30% Wants

20% Savings

60% Commitment

30% Wants

10% Savings

70% Commitment

20% Wants

10% Savings

80% Commitment

20% Wants

Based on your selected commitment load, here are your ideals breakdowns.

50% For Commitments

RM 0.00

30% For Wants (Budgetable)

RM 0.00

20% For Savings

RM 0.00

Spending money to show people how much money you have, is the fastest way to have less money.

— Psychology of Money, Morgan Housel

Why do I need to budget?

Stress less about bills

When you budget, you plan for bills ahead of time, so you're not caught off guard at the end of the month scrambling to pay rent.

Total spent

RM 1,400.00

Spendable

RM 1,600.00

Spending Cap

RM 3,000.00

Know exactly where your money goes

It’s easy to lose track of spending. Budgeting helps you see exactly where your cash is going, so you can avoid those "where did all my money go?" moments.

Avoid overspending

A budget acts like a friendly reminder to not blow all your money on impulse buys—because, let’s face it, it happens!

Disclaimer: Kita Budget is provided for informational and reference purposes only. We do not keep and use your data at all. The calculations performed by this calculator are not intended to replace or substitute for professional advice or professional financial office/banker calculations provided by any banks or other relevant financial service providers.

©2024 Copyrighted. Made with 🖤 by 🌪️TornadoByte